Philippine logistics demand to grow by 160,000sqm annually over the next 10 years

E-commerce firms and third-party logistics are driving the demand for high-specification spaces.

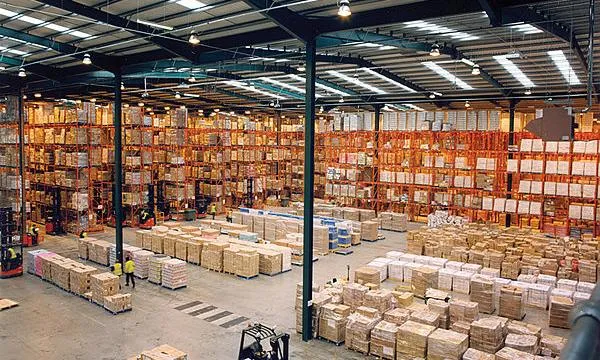

Demand for logistics space in the Philippines has been generally positive, but addressing the increasing demand for better quality facilities from new entrants in the market could translate to approximately 160,000 square meters per annum of new demand in the next 10 years.

This is according to JLL Philippines’ latest research “The Evolution of Philippine Logistics: A Case for Better Quality Logistics,” which presents key macro and real estate trends that suggest the potential of the sector and the prospects for new quality grade space in the market.

“With our latest publication, we aim to provide a thorough factual analysis on the state of the logistics sector today, correlate these data with current economic realities and deduce the sector’s future for investment purposes,” says JLL Philippines Country Head Christophe Vicic.

Existing logistics stock in the Philippines as of the first quarter of 2020 stood at 1.7 million square meters, with about 424,000 square meters of upcoming supply scheduled for completion through 2021. Dry storage makes up two-thirds of the existing supply, while cold storage and cold and dry storage contribute 21% and 12%, respectively.

“While there is a positive demand for logistics space in the country as reflected in the uptick in transaction activity in recent years, there is an increasing demand for better quality facilities, mostly from e-commerce firms and third-party logistics (3PLs) requiring high-specification warehouses that utilize technology and digital tools as part of their operations,” says Tom Over, JLL Philippines’ Director for Industrial and Logistics.

“The logistics sector is currently seen as the evolving asset class in the Philippines, with a number of established developers looking to increase their exposure in the sector. Focus on efficiency, specification, sustainability, and amenities puts the market at a turning point for growth and improvement in quality,” he continues.

In the report, JLL identifies the sector’s key pillars that should be addressed to meet the demand for better quality logistics facilities:

- Efficiency. As the majority of total logistics costs arises on transport element, increasing the efficiency of operations across the real estate can reduce lag or waiting times for loading/unloading.

- Consolidation. To further optimise costs, logistics operators require larger, more voluminous warehouse space in a single site, instead of multiple smaller facilities across geographies.

- Decentralization. Key logistics, fast-moving consumer goods and e-commerce players are looking for opportunities outside Metro Manila due to rising land values and rental values brought by continued urbanization. While CALABARZON is observed to be the dominant area for logistics activities, JLL projects that growth direction is going towards Central Luzon. Meanwhile, Davao Region is seen to rise to a double-digit rate from below a percent record at present.

- Workforce. Large distribution centers employ a supply chain team to organize and manage the operations. Therefore, modern facilities require fully fitted and integrated two-storey offices. Operators need to create comfortable workplaces to attract talent.

- Sustainability. Logistics developers are continuing to reduce carbon footprint and reduce energy costs for the occupiers.

Positive outlook

Despite the presence of challenges posted by the pandemic such as the holding of end-user demand, the slowing down of delivery, and the disruption of global supply chain, JLL reports that the Philippine logistics sector shows signs of resiliency. These opportunities are primarily from the rising cold storage demand and growing e-commerce landscape.

Moreover, JLL says that accelerated adaptation to e-commerce platforms, strengthening supply chain risk management, and expansion of last-mile fleet—or the movement of goods from logistics facility/hub to final destination—should be addressed by the market to allow it to grow by 56% in the next five years and a triple-digit increase of 125% in the next 10 years.

“The outlook requires that a sustained improvement in e-commerce platform should take place along with the growing trade balance with other countries and favourable manufacturing sector,” says Janlo de los Reyes, JLL Philippines Head of Research and Consultancy. “JLL believes that logistics space developers and operators should adapt with the evolving demand brought by technology innovations and thus, build modern facilities to achieve the projections.”

Advertise

Advertise